The Classic Pump and Dump

Thursday 7 July 2011

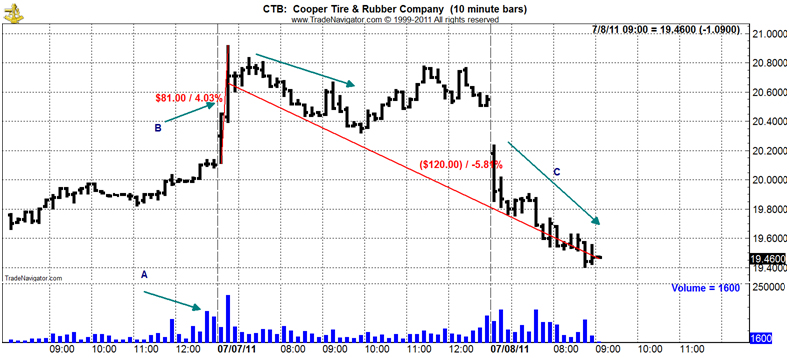

This morning CNBC featured an interview with the so-called expert in stocks. He recommended several stocks making the case that one stock in particular, Cooper Tire & Rubber (CTB) was an outstanding buy because they dealt with replacement tires and that given economic improvement as well as increased automobile sales their business would do much better in the stock reversed its downtrend. He recommended a strong buy on the stock. Naturally as is often the case that stock jumped significantly after his recommendation. This is a typical move as the usually uninformed CNBC audience hungry for good trades jumped on board. I've seen it so many times that it actually makes me laugh but it's really quite sad. So I did what I usually do when this happens I looked at the intraday chart of CTB with trading volume just to reconfirm what I've seen so often. I expected that the stock would jump on heavy volume which it did and I also expected that the next day, Friday, the stock would get dumped as disappointed traders were exiting. Although I can't prove it and therefore can't make the claim that the stock was pumped up in order for those who were long to get out of the stock I do have my suspicions. I'm making a copy of this chart for myself and printing it here in my diary so that I can look back and see what happened therefore confirming my expectation and solidifying my learning.

At point A which was the day before late in the day there was a spike in volume. It was a significant spike which I believe although I can't prove it was caused by those who knew this individual is going to be on television recommending the stock. I suspect that they were buying in advance of the recommendation being made on CNBC. At point B the recommendation to buy is given on the show and the stock jumps over 4% in a matter of 20 minutes. This was of course the reaction of the trade hungry public looking for good stocks. As in most cases it was bound to lead to disappointment over the next few hours the stock is being dumped as professionals who did the setup are exiting to the public which is buying. Of course this is all conjecture on my part but nonetheless the pattern is clear and has been repeated many times. The next day the stock takes a big hit going sharply lower on the day. Up to the point where this chart is being made the stock drops over 5% giving back everything it made on the initial surge plus more. Those who bought the stock on the recommendation are disappointed. Having said that this does not mean I'm not interested in the stock I'm willing to buy the stock now on the big reaction down provided I have other valid technical indicators to do so. Lesson learned again the pump and dump works for the professional and the public gets the shaft.